Regulation for Enforcement of the Act on Deposit Transactions(Cabinet Office Order No. 1 of 2022)

Last Version: Cabinet Office Order No. 13 of 2023

目次

履歴

-

▶本則

-

令和6年4月25日

- 最終更新:令和五年内閣府令第十三号

- 翻訳日:令和5年10月18日

- 辞書バージョン:16.0

-

令和5年11月7日

- 最終更新:令和五年内閣府令第十三号

- 翻訳日:令和5年10月18日

- 辞書バージョン:16.0

Regulation for Enforcement of the Act on Deposit Transactions (Any data that the title of a law indicates to be a "Tentative translation" has not yet been proofread or corrected by a native English speaker or legal translation expert; this data may be revised in the future.Tentative translation)

(Cabinet Office Order No. 1 of 2022).

Pursuant to the provisions of the Act on Deposit Transactions (Act No. 62 of 1986) and the Order for Enforcement of the Act on Deposit Transactions (Cabinet Order No. 340 of 1986), in order to enforce that Act and that Order, the Regulation for Enforcement of the Act on Deposit Transaction Agreements (Order of the Ministry of International Trade and Industry No. 75 of 1986) is established as follows.

(The Period Set Forth by the Cabinet Office Order Referred to in Article 2, Paragraph (1), Item (i) of the Act)

Article 1The period specified by Cabinet Office Order, referred to in Article 2, paragraph (1) of the Act on Deposit Transactions (hereinafter referred to as the "Act"), is three months.

(Delivery of Documents Before the Conclusion of a Deposit Transaction Agreement)

Article 2(1)The matters specified by a Cabinet Office Order, referred to in Article 3, paragraph (1), item (i) of the Act, are the following matters:

(i)the trade name, name, address, and telephone number of the depository service provider, and, if the depository service provider is a corporation, the name of the representative;

(ii)the type, quantity, and value of goods, or contents and value of specified rights;

(iii)the duration for which the deposit service provider will accept deposits for the goods, or the duration for which they will manage the specified rights;

(iv)the means of returning goods to the depositor, allowing the depositor to acquire the specified rights, or delivering money or other alternative goods to the depositor;

(v)the amount of money delivered to the depositor, in lieu of the return of goods to the depositor or acquisition of the specified rights by the depositor, or the means of calculating the amount;

(vi)the type, quantity, and value of alternative goods delivered in lieu of the return of goods to the depositor or acquisition of the specified rights by the depositor, or the means of calculating them;

(vii)the amount of economic benefits provided (for economic benefits that are provided other than money, the value of said benefits);

(viii)the details of the economic benefits to be delivered, and the timing and method of the delivery (for agreements under which the goods or the specified rights will be purchased, the purchase price or the method used for the calculation thereof);

(ix)the rate or amount of the fees collected from depositors, and the timing and method of collection thereof;

(x)matters concerning the cancellation of deposit transaction agreements (including matters concerning the provisions of Article 7, paragraphs (1) through (4), Article 8, paragraphs (1) and (2), and Article 17, paragraphs (1) through (4) of the Act);

(xi)if there are provisions relating to the planned amount of liquidated damages (including penalties for breach of agreement), the contents thereof;

(xii)whether or not there are any measures to secure the return of the goods to the depositor or to allow the depositor to acquire the specified rights (including measures to secure the delivery of money or other alternative goods to the depositor, in lieu of the return thereof or the acquisition thereby), and if there are, the details thereof;

(xiii)the name, address, and telephone number of institutions with which customers can conduct inquiries or consultations regarding agreements; and

(xiv)beyond what is set forth in the preceding items, when there are special agreements concerning the contents or performance of agreements, the contents thereof.

(2)The matters specified by a Cabinet Office Order, referred to in Article 3, paragraph (1), item (ii) of the Act, are the following matters:

(i)the name and address of main office, branch office, and other offices;

(ii)in the case of a corporation, the name and title of its officers (meaning members engaged in services, directors, executive officers or persons equivalent to these);

(iii)the commencement date of the business pertaining to deposit transactions;

(iv)outline of business pertaining to deposit transactions in the immediate business year;

(v)the amount of stated capital or the total amount of investment;

(vi)the amount of funds necessary for carrying out business pertaining to deposit transactions and how to raise them;

(vii)regarding goods or specified rights that a depository service provider or a closely related person seeks to sell, (limited to those that make said goods or specified rights the subject of the deposit transaction agreement) the quantity of the goods or specified rights currently held by the depository service provider or a closely related person;

(viii)management system of goods deposits and managed specified rights; and

(ix)whether or not there is an external audit concerning the status of the business and property and if there are, the name of the person that conducted the external audit, the subjects of the external audit, and the outline of the results.

(3)When a document containing the matters set forth in the items of Article 3, paragraph (1) of the Act is delivered, it shall follow the rules specified in the following items:

(i)the information must be provided accurately using terms that are easy to read and understand for the customer;

(ii)the letters and numbers must be of font size 8 points or larger as provided for in the Japanese Industrial Standards Z 8305; and

(iii)contents of the document that should be read thoroughly should be framed in red and stated using red letters of font size 12 points or larger as provided for in the Japanese Industrial Standards Z 8305.

(Delivery of Documents upon the Conclusion of a Deposit Transaction Agreement)

Article 3(1)The matters specified by a Cabinet Office Order, referred to in Article 3, paragraph (2), item (viii) of the Act, are the following matters:

(i)the trade name, name, address, and telephone number of the depository service provider, and, if the depository service provider is a corporation, the name of the representative;

(ii)the name and title of the person who concluded or renewed the agreement;

(iii)the name and address of the depositor;

(iv)the date of the conclusion or renewal of the agreement;

(v)the name and address of the location where the goods deposits and managed specified rights are managed, and the means thereof;

(vi)the means of returning goods to the depositor, allowing the depositor to acquire the specified rights, or delivering money or other alternative goods to the depositor;

(vii)the amount of money delivered to the depositor, in lieu of the return of goods to the depositor or acquisition of the specified rights by the depositor, or the means of calculating the amount;

(viii)the type, quantity, and value of alternative goods delivered in lieu of the return of goods to the depositor or acquisition of the specified rights by the depositor, or the means of calculating them;

(ix)the amount of economic benefits provided (for economic benefits that are provided other than money, the value of said benefits);

(x)matters concerning the renewal of agreements;

(xi)the location where it is possible to inspect documents specified in Article 6, paragraph (1) of the Act and books and documents specified in paragraph (2) of the same Article, and the means of inspecting and requesting copies;

(xii)the name, address, and telephone number of institutions with which depositors can conduct inquiries or consultations regarding agreements; and

(xiii)beyond what is set forth in the preceding items, when there are special agreements concerning the contents or performance of agreements, the contents thereof.

(2)The matters specified in Article 3, paragraph (2), item (v) of the Act contained in delivered documents as specified in the same paragraph must contain the following contents:

(i)the depositor may cancel a deposit transaction agreement by submitting a document or electronic or magnetic record (meaning a record used in computer data processing which is created in electronic form, magnetic form, or any other form that cannot be perceived by the human senses; the same applies hereinafter) during the period until 14 days have passed since the date of the receipt of the documents specified in Article 3, paragraph (2) of the Act (including means in cases where a deposit transaction agreement is cancelled through a electronic or magnetic record; the same applies in the following item and Article 14, paragraph (1), item (ii));

(ii)notwithstanding the matters stated in the preceding item, when a depositor has not cancelled a deposit transaction agreement pursuant to the provisions of Article 7, paragraph (1) of the Act because the depositor was under the misapprehension that information about canceling the deposit transaction agreement under the provisions of the same paragraph that the depository service provider had misrepresented to the depositor, or because the depositor was overwhelmed due to the depository service provider's use of intimidation, the depository service provider shall deliver a document stating that the deposit transaction agreement can be cancelled pursuant to the provisions of the same paragraph, and the depositor may cancel the deposit transaction agreement through a written document or electronic or magnetic record during the period until 14 have passed since the date on which the depositor received the document;

(iii)the cancellation of a deposit transaction agreement under the preceding two items takes effect at the time it is set forth in writing or through a notification by electromagnetic records that the deposit transaction agreement is cancelled;

(iv)when a deposit transaction agreement is cancelled under item (i) or item (ii), the depository service provider may not claim damages or demand payment of a penalty pertaining to the cancellation of the agreement;

(v)when a deposit transaction agreement is cancelled under item (i) or item (ii), the depository service provider bears the costs required for returning any goods pertaining to deposit transaction agreements or terminating the management of specified rights;

(vi)after 14 days have passed since the date of receipt of the documents specified in Article 3, paragraph (2) of the Act, the depositor may cancel a deposit transaction agreement from then on;

(vii)when a deposit transaction agreement is cancelled under the preceding item, a depository service provider may not demand that a depositor pay an amount of money that exceeds an amount equivalent to the amount of the value of the relevant good or specified right calculated at the statutory interest rate at the time of the conclusion of the deposit transaction agreement;

(viii)when a deposit transaction agreement is cancelled under item (i) or item (ii), the sales contract (limited to those that obtained confirmation as set forth in Article 14, paragraph (2) of the Act and were concluded on or after the date confirmation was obtained as set forth in the same paragraph; the same applies hereinafter in this paragraph) pertaining to the good or specified right that is the subject of the deposit transaction agreement that is currently valid is deemed to be cancelled by the depositor at the time of said cancellation;

(ix)when a sales contract is deemed to be cancelled as set forth in the preceding item, a depository service provider or a closely related person may not claim damages or demand payment of a penalty pertaining to the rescission of the sales contract;

(x)when a sales contract is deemed to be cancelled as set forth in item (viii) and the delivery of goods or transfer of specified rights pertaining to sales contract has already been carried out, the depository service provider or closely related person who sold the goods or specified rights bears the cost required to return them; and

(xi)when a sales contract is deemed to be cancelled as set forth in item (viii), even if the goods delivered based on the sales contract have already been used or the rights have already been exercised, neither the depository service provider nor any closely related person may demand that the depositor pay money equivalent to any profits earned through the use of the goods or through the exercise of the rights or any other monetary payments.

(3)When a document containing the matters set forth in the items of Article 3, paragraph (2) of the Act is delivered, it shall follow the rules specified in the following items:

(i)the information must be provided accurately using terms that are easy to read and understand for the depositor;

(ii)the letters and numbers must be of font size 8 points or larger as provided for in the Japanese Industrial Standards Z 8305; and

(iii)the following matters should be framed in red and stated using red letters and numbers of font size 12 points or larger as provided for in the Japanese Industrial Standards Z 8305;

(a)contents of the document that should be read thoroughly;

(b)the contents provided for in the items in the preceding paragraph;

(c)a request may be made for the inspection or copying of the documents set forth in Article 6, paragraph (1) of the Act or the books and documents set forth in paragraph (2) of the same Article; and

(d)when the documents set forth in Article 6, paragraph (1) of the Act or the books and documents set forth in paragraph (2) of the same Article have been prepared as electronic or magnetic records, a request may be made to submit the matters recorded on the electronic or magnetic records or deliver documents containing said matters.

(Means Using Information Communication Technology)

Article 4(1)The means specified by a Cabinet Office Order, referred to in Article 3, paragraph (3) of the Act, are the following means:

(i)means that uses an electronic data processing system and is listed in (a) or (b);

(a)means of transmitting information through a telecommunications line that connects the computer used by the depository service provider and the computer used by the customer or depositor, and recording said information in a file on the computer used by the customer or depositor; and

(b)means of providing the information to be provided in the documents, which are recorded in a file on the computer used by the depository service provider, to the customer or depositor for inspection via an electric telecommunication line so as to record the relevant information in the file on the computer used by the customer or depositor.

(ii)means of delivering a file, prepared in the form of a recording media for electronic or magnetic records, that contains the matters to be indicated in a document.

(2)The means set forth in the items of the preceding paragraph must conform to the following standards:

(i)it enables the customer or depositor to create a document by outputting the information recorded in a file;

(ii)measures are taken to allow the confirmation of whether the matters to be stated in documents that are recorded in a file have been altered; and

(iii)with regard using the means specified in item (i), sub-item (b) of the preceding paragraph, the customer or depositor shall be notified of the fact that the matters stated in documents that are stored in a file will be or have been recorded in a file on a computer used by the depository service provider.

(3)The "electronic data processing system" set forth in paragraph (1), item (i) shall mean the electronic data processing system that connects the computer used by the depository service provider and the computer used by the customer or depositor through a telecommunication line.

(Types and Details of the Electronic or Magnetic Means)

Article 5The type and details of the electronic or magnetic means to be indicated pursuant to the provisions of Article 3, paragraph (1) of the Order for Enforcement of the Act on Deposit Transactions (hereinafter referred to as the "Act") are the following matters:

(i)among the means listed in the items of paragraph (1) of the preceding paragraph, those used by a depository service provider; and

(ii)the format in which the matters have been recorded in the file.

(Explanation and Confirmation When Obtaining Consent)

Article 6(1)When indicating the matters set forth in the items in the preceding Article, a depository service provider must explain the following particulars to the customer or depositor:

(i)if the customer or depositor does not receive the explanations set forth in this paragraph or confirmation in paragraph (3) and does not give consent pursuant to the provisions of Article 3, paragraph (3) of the Act, the documents specified in paragraph (1) or (2) of the same Article shall be delivered;

(ii)the particulars provided through electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act are the particulars that must be stated in documents as set forth in paragraphs (1) and (2) of the same Article and are important to the customer or depositor;

(iii)when the particulars that are required to be stated in documents are provided by electronic or magnetic means, as set forth in Article 3, paragraph (2) of the Act (limited to means set forth in Article 4, paragraph (1), item (i)), they are deemed to have reached the depositor when the matters are recorded in a file on a computer used by the depositor, and the time of the deemed arrival is the initial date for calculating the period in which the deposit transaction agreement can be cancelled pursuant to the provisions of Article 7, paragraph (1) of the Act; and

(iv)only customers and depositors that use computers or other equipment necessary to inspect particulars provided by electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act (meaning computers with a screen the maximum diameter of which is, when divided by 2.54 and when the decimal places are rounded off, value rounded off is five centimeters or more; the same applies hereinafter in this Article) on a daily basis and are able to operate (meaning to operate until the provision is complete; the same applies in paragraph (3), item (i)) computer for the provision on their own may receive through electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act.

(2)When giving explanations specified in the preceding paragraph, depository service providers must use plain language so that the customer or depositor can understand.

(3)Depository service providers must confirm the following matters upon giving the explanations set forth in paragraph (1):

(i)the customer or depositor is able to transmit electronic mail (meaning electronic mail prescribed in Article 2, item (i) of the Act on Regulation of Transmission of Specified Electronic Mail (Act No. 26 of 2002); the same applies hereinafter) or performs any other operations necessary for the inspection of particulars provided by electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act on their own, and the customer or depositor uses a computer and e-mail address (meaning an e-mail address as specified in Article 2, paragraph (3) of the Act on Regulation of Transmission of Specified Electronic Mail; the same applies in item (iii)) necessary for said inspection on a daily basis (limited to cases of provision by electronic mail);

(ii)the customer or depositor has ensured cybersecurity (meaning cybersecurity as specified in Article 2 of the Article 2 of the Basic Act on Cybersecurity (Act No. 104 of 2014)) pertaining to computers necessary for the inspection of the particulars provided by electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act; and

(iii)whether or not the customer or depositor intends to transmit the particulars provided by electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act to a person designated by the customer or depositor in advance through electronic mail and, if they intend to transfer, the e-mail address of said person.

(4)When performing the confirmation set forth in the preceding paragraph a depository service provider must use a means through which the customer or depositor operates a computer that they use on a daily basis and uses the depository service provider's website.

(5)A depository service provider shall obtain consent pursuant to the provisions of Article 3, paragraph (3) of the Act by stating the customer or depositor's name and the fact that the customer or depositor understands the content of the explanations specified in paragraph (1) in a document, etc. as specified in Article 3, paragraph (1) of the Order. In this case, the depository service provider must include a marking or use other means of clarifying that the customer or depositor recognizes said consent.

(6)When a customer or depositor intends to transfer an electronic mail pursuant to the provisions of paragraph (3), item (iii), a depository service provider must transfer an electronic mail to a person designated in advance by the customer or depositor at the same time as the provision through electronic or magnetic means pursuant to Article 3, paragraph (3) of the Act.

(7)Upon explanation as specified in paragraph (1) and confirmation specified in paragraph (3), when obtaining consent pursuant to the provisions of Article 3, paragraph (3) of the Act, a depository service provider must deliver a document proving that said consent was obtained (including a copy of said document when said consent was obtained in writing) by the time of the provision to the customer or depositor through electronic or magnetic means as specified in the same paragraph; provided, however, that, if the particulars to be stated in a document as set forth in Article 3, paragraph (1) of the Act are provided through electronic or magnetic means, a document proving that relevant consent was obtained can be provided through electronic or magnetic means.

(Obtaining Consent by Use of Information and Communications Technology)

Article 7(1)The means specified by a Cabinet Office Order, referred to in Article 3, paragraph (1) of the Order, are the following means:

(i)means that uses an electronic data processing system and is listed in (a) or (b);

(a)means of transmitting consent or the fact that consent will be submitted (hereinafter referred to as "consent, etc." in this paragraph) through a telecommunications line that connects a computer used by a customer or depositor and a computer used by the depository service provider, and recording it in a file on the computer used by the depository service provider; and

(b)means of offering the type and details of the electronic or magnetic means as set forth in the items in Article 5 that are recorded in a file on a computer used by the depository service provider through a telecommunications line for inspection by a customer or depositor, and recording the fact that consent, etc. is given in a file on said computer.

(ii)means of delivering a file, prepared in the form of a recording media for electronic or magnetic records, that contains the fact that consent, etc. is given.

(2)The methods set forth in the items of the preceding paragraph must be one that enables the depository service provider to prepare documents by outputting the records in the file.

(Confirmation Pursuant to the Provisions of Article 3, Paragraph (3) of the Order)

Article 8Confirmation pursuant to Article 3, paragraph (3) of the Order shall be made by confirming that the matters have been recorded in a file on a computer used by the depositor by telephone, by means of using an electronic data processing system, or by any other means and are stored in a state in which they can be inspected by the depositor.

(Means Specified by a Cabinet Office Order, Referred to in Article 3, Paragraph (4) of the Act)

Article 9The means specified by a Cabinet Office Order, referred to in Article 3, paragraph (4) of the Act, are the means set forth in Article 4, paragraph (1), item (ii).

(Acts Which Fall Short of Protecting Customers or Depositors)

Article 10The acts specified by a Cabinet Office Order, referred to in Article 5, paragraph (2) of the Act, are the following acts:

(i)false representation or acts of misleading customers or depositors regarding the details of deposit transaction agreements or matters related to the performance thereof, or matters related to the status of the depository service provider's business and property when advertising a deposit transaction (including similar acts specified in Article 16);

(ii)acts to solicit without stating the depository service provider's trade name, name, or the fact that the purpose of the solicitation is to conclude or renew a deposit transaction agreement, prior to solicitation of the conclusion or renewal of a deposit transaction agreement;

(iii)acts of soliciting a customer that has not requested to be solicited to conclude a deposit transaction agreement (limited to deposit transaction agreements that cover goods or specified rights that a depository service provider or closely related person intends to sell or has already sold; the same applies in the following item and item (v)) by visiting them, telephoning them, or using the following means.

(a)means of transmitting electronic or magnetic records to a communication terminal carried and used by a employer using a telephone number for transmissions;

(b)means of transmitting electronic mail; or

(c)beyond what is provided for in (b), means of transmission by telecommunications used to convey information to people who are specified as those who are to receive information (meaning the telecommunications as prescribed in Article 2, item (i) of the Telecommunications Business Act (Act No. 86 of 1984));

(iv)act of soliciting a customer to conclude a deposit transaction agreement without obtaining confirmation from the customer, prior to solicitation, regarding whether or not the customer is willing to be solicited;

(v)continuing to solicit a customer to conclude a deposit transaction agreement despite the customer having manifested an intention that indicates an unwillingness to conclude said deposit transaction agreement (including an intention that indicates a wish not to continue to be solicited) after being solicited;

(vi)intentionally failing to disclose facts regarding matters related to information (excluding matters set forth in the items of Article 4 of the Order, including matters related to information necessary for the conclusion of sales contracts pertaining to goods or specified rights that are the subject of the relevant deposit transaction agreement) necessary for a customer to conclude or renew a deposit transaction agreement or misrepresenting information when soliciting the conclusion or renewal of a deposit transaction agreement or for the purpose of preventing the cancellation of a deposit transaction agreement;

(vii)the following acts concerning provision by electronic or magnetic means pursuant to the provisions of Article 3, paragraph (3) of the Act:

(a)acts of continuing procedures pertaining to provision through electronic or magnetic means in relation to customers or depositors that indicate that they do not seek provision through electronic or magnetic means;

(b)misrepresenting facts regarding information that would affect the decision of the customer or depositor;

(c)use of intimidation to overwhelm (excluding acts specified Article 4, paragraph (2) of the Act);

(d)providing economic benefits;

(e)collecting expenses or otherwise inflicting economic disadvantages regarding the delivery of documents pursuant to the provisions of Article 3, paragraph (1) or (2) of the Act;

(f)when obtaining the confirmation under Article 6, paragraph (3), unduly influencing a customer or depositor through deceit or other wrongful means;

(g)providing without obtaining the confirmation specified in Article 6, paragraph (3), or providing a customer or depositor for which confirmation cannot be obtained pursuant to the same paragraph through electronic or magnetic means;

(h)giving consent on behalf of the customer or depositor through deceit or other wrongful means, or receiving the matters being provided through electronic or magnetic means; and

(i)beyond what is set forth in (a) through (h), making a customer or depositor give consent against their will or making them receive the matters provided through electronic or magnetic means;

(viii)soliciting a customer or depositor to conclude or renew a deposit transaction agreement or preventing the cancellation of a deposit transaction agreement in a way that would likely be a nuisance; and

(ix)failure to appropriately manage goods deposits or managed goods.

(Documents Concerning Business and Property)

Article 11(1)When keeping documents pursuant to Article 6, paragraph (1) of the Act, a depository service provider must prepare the documents in the following items within the period specified in the respective item and keep them at each place of business where they perform business related to deposit transactions.

(i)a balance sheet prepared based on the provisions of the Regulations on Corporate Accounting (Ministry of Justice Order No. 13 of 2006), a profit and loss statement, a statement of changes in net assets or statement of changes in members' equity, tables of explanatory notes on unconsolidated financial statements or annexed detailed statements: within three months after the end of each business year; and

(ii)documents concerning the status of held goods deposits or status of the management of managed specified rights as of the last day of each month: on the 10th of the month following the respective month;

(2)The documents specified in the preceding paragraph must be kept in the relevant place of business within the period from the day the documents are first kept and until three years have passed.

(3)When a depository service provider prepares the documents specified in paragraph (1) through electronic or magnetic means based on the provisions of the same paragraph, it must do so by a means of recording the created electronic or magnetic records on a file stored in a computer used by the depository service provider or by means of recording medium containing electronic or magnetic records.

(4)When preparing the contents of the documents specified in paragraph (1) through electronic or magnetic means and keeping them so that they can be immediately displayed by using a computer or any other device as needed, electronic or magnetic records may be kept in lieu of the documents specified in Article 6, paragraph (1) of the Act. In this case, a depository service provider must take necessary measures to prevent the loss or damage of said electronic or magnetic records.

(5)Documents are deemed to be kept at a place of business when, based on the provisions of paragraph (1), a depository service provider keeps the electronic or magnetic records of said documents in at least one place of business among two or more places of business, and measures are taken so that the matters in the matters recorded in said electronic or magnetic records can be displayed on a screen of a computer at another place of business or outputted to a document.

(Books and Documents Concerning Deposit Transaction Agreements)

Article 12(1)For each deposit transaction agreement with the same depositor, a depository service provider must prepare the books and documents specified in Article 6, paragraph (2) of the Act by creating the documents listed in each item within the period set forth in the respective item:

(i)a copy of the document specified in Article 3, paragraph (1) of the Act: within one week after the delivery of said documents;

(ii)a copy of the document specified in Article 3, paragraph (2) of the Act: within one week after the delivery of said documents; and

(iii)reports concerning the status of held goods deposits or the status of managed specified rights and the status of the provision of economic benefits as of the last day of each month: by the 10th of the month following the respective month;

(2)The books and documents in the preceding paragraph must be kept from the day the relevant deposit transaction agreement ends until one year have elapsed.

(3)The provisions of paragraph (3) of the preceding paragraph apply mutatis mutandis to the preparation of electronic or magnetic records of the books and documents specified in paragraph (1), and the provisions of paragraph (4) of the same Article apply mutatis mutandis to the keeping of electronic or magnetic records of the books and documents specified in paragraph (1). In these cases, "Article 6, paragraph (1)" shall be deemed to be replaced with "Article 6, paragraph (2)."

(Requests for Inspection or Copy)

Article 13(1)A depositor may make the following requests at any time during the business hours of a depository service provider:

(i)when the documents specified in Article 6, paragraph (1) of the Act or documents specified in paragraph (2) of the same Article are being prepared in writing, requests to inspect or copy said documents;

(ii)when the documents specified in Article 6, paragraph (1) of the Act or books and documents specified in paragraph (2) of the same Article are being prepared as electronic or magnetic records, requests to inspect or copy matters recorded in said electronic or magnetic records and indicated on paper or on the screen of an output device; and

(iii)requests for the provision of the matters recorded in electronic or magnetic record as specified in the preceding item through any of the following means or the requests for the delivery of documents stating said matters:

(a)a means of using an electronic data processing system that links a computer used by a depository service provider with a computer used by a depositor via a telecommunications line and in which the information transmitted over the telecommunications line is recorded in a file that has been prepared on the computer used by the depositor; or

(b)a means of delivering a file, prepared in the form of a recording media for electronic or magnetic records, that contains information;

(2)The methods listed in item (iii) of the preceding paragraph must enable a depositor to create a document by outputting the information recorded in a file.

(Providing Documents after Cancellation of Deposit Transaction Agreement is Prevented)

Article 14(1)The documents delivered pursuant to the provisions of Article 7, paragraph (1) of the Act (simply referred to as "documents" in the following paragraph and paragraph (3)) must contain the following particulars:

(i)the matters listed in Article 3, paragraph (2), items (i) to (iii) of the Act;

(ii)the fact that the deposit transaction agreement can be cancelled through writing or electronic or magnetic record within 14 days after the date the documents are received based on the provisions of Article 7, paragraph (1) of the Act;

(iii)matters concerning the provisions of Article 7, paragraphs (2) through (4) of the Act;

(iv)the depository service provider's trade name, name, address, and telephone number, and, if the depository service provider is a corporation, the name of the representative;

(v)the name and title of the person who concluded or renewed the agreement; and

(vi)the date of the conclusion or renewal of the agreement.

(2)The documents must be written using red letters and numbers of font size 8 points or larger as provided for in the Japanese Industrial Standards Z 8305.

(3)When writing the documents, the contents of the matters specified in paragraph (1), items (2) and (3) must be written in red letters and surrounded by a red frame.

(4)When providing documents to a depositor as specified in Article 7, paragraph (1) of the Act a depository service provider must confirm the depositor has seen the documents and notify the depositor of the contents of the matters specified in paragraph (1), items (ii) and (iii).

(Persons Closely Related to Depository Service Providers)

Article 15A person specified by Cabinet Office Order as a person closely related to a depository service provider pursuant to the provisions of Article 9, paragraph (1) of the Act is a person who performs the sales of a good or specified right that is the subject of a deposit transaction agreement, or the agency or intermediary service thereof.

(Acts Similar to Advertising)

Article 16The acts specified by Cabinet Office Order as provided in Article 9, paragraph (1) of the Act are means of transmission by mail, postal mail, Correspondence Delivery Service (meaning correspondence delivery as prescribed in Article 2, paragraph (2) of the Act on Correspondence Delivery by Private Business Operators (Act No. 99 of 2002) provided by a general letter service business operator as prescribed in paragraph (6) of that Article or a specified letter service business operator as prescribed in paragraph (9) of that Article), or facsimile device, means of transmitting an electronic or magnetic record to a communication terminal carried and used by the counterparty using a phone number, means of sending telecommunication to a specified recipient (including means of sending electronic mail), means of distributing fliers or pamphlets, or other means providing information with the same content to many persons (excluding distribution of documents prepared in accordance with laws or regulations, or in accordance with the dispositions rendered by administrative agencies under the laws and regulations).

(Matters to Be Stated in Written Applications)

Article 17The matters specified by a Cabinet Office Order, referred to in Article 10, paragraph (1), item (vi) of the Act, are the following matters:

(i)the contents of the goods or specified rights pertaining to a sales contract (meaning a sales contract specified in the first sentence of Article 9, paragraph (1) of the Act; the same applies hereinafter) that a depository service provider or closely related person seeks to conclude;

(ii)the matters set forth in Article 2, paragraph (1), items (iv) through (vi) and items (viii) through (xii);

(iii)the matters set forth in Article 2, paragraph (2), items (iii) through (ix);

(iv)the period in which a depository service provider seeks to solicit;

(v)the selection criteria and the scope of customers which the depository service provider seeks to solicit;

(vi)the trade name, name, address, and telephone number of the solicitor and the closely related person, and, if the either of them is a corporation, the name of the representative;

(vii)when seeking to solicit the conclusion or renewal of a deposit transaction agreement pursuant to the second sentence of Article 9, paragraph (1) of the Act, information about any circumstances necessary for the customer to conclude or renew the deposit transaction agreement; and

(viii)when seeking to obtain consent pursuant to the provisions of Article 3, paragraph (3) of the Act, the period and method of the consent, and type and details of the electronic or magnetic means used to provide as specified in the same paragraph.

(Documents to Be Attached to Written Applications)

Article 18The matters specified by a Cabinet Office Order, referred to in Article 10, paragraph (2), item (iv) of the Act, are the following matters:

(i)documents proving the amount of additional corporate taxes charged and amount of corporate taxes paid in the past year, for each fiscal year;

(ii)documents stating the prospects of the operation of goods deposits or managed specified rights and, if they are currently being operated, records of the operation (records for a period of three years or more including the past three business years including the date of application);

(iii)documents clearly stating that the depository service provider has the financial basis necessary to perform business pertaining to deposit transactions;

(iv)documents containing a biographical outline of officers pursuant to Article 10, paragraph (1), item (iii) of the Act;

(v)documents stating the name and title of the person responsible for managing goods deposits or managed specified rights;

(vi)a list of persons engaged in business pertaining deposit transactions;

(vii)an organization chart concerning the business pertaining to deposit transactions (including an organization chart related to the system specified in Article 11, paragraph (1), item (iv) of the Act);

(viii)the internal rules, etc. (meaning internal rules and other rules equivalent thereto) concerning the business pertaining to deposit transactions;

(ix)materials clearly stating the means and timing of solicitation and other details;

(x)documents stating matters to be taken in consideration of the customer's knowledge, experience, and financial status and the purpose for soliciting to conclude or renew a sales contract or deposit transaction agreement; and

(xi)beyond the documents set forth in the preceding paragraph, any documents deemed necessary to determine whether or not to grant confirmation as specified in Article 9, paragraph (1) of the Act by the Secretary General of the Consumer Affairs Agency.

(Matters Concerning Management Systems)

Article 19The matters specified by a Cabinet Office Order, referred to in Article 11, paragraph (1), item (iv) of the Act, are the following matters:

(i)the name and address of the location where the goods deposits and managed specified rights are managed, and the means thereof; and

(ii)beyond what is set forth in the preceding paragraph, matters concerning systems necessary for ensuring the appropriate management of goods deposits or managed specified rights.

(Subjects of Examination)

Article 20The matters specified by a Cabinet Office Order, referred to in Article 11, paragraph (1), item (vi) of the Act, are the following matters:

(i)the timing and method of delivering economic benefits provided to customers for each deposit transaction agreement that an applicant seeks to conclude or renew;

(ii)the purchase price of a deposit transaction agreement purchasing goods or specified rights, or the method used for the calculation thereof;

(iii)the details of the solicitation by the depository service provider or closely related person and matters for ensuring the appropriateness of the solicitation; and

(iv)when seeking to obtain consent pursuant to the provisions of Article 3, paragraph (3) of the Act, matters for ensuring the appropriateness of the consent.

(Minor Changes)

Article 21(1)Minor changes provided in Cabinet Office Order as provided in the proviso of Article 12, paragraph (1) of the Act are the following matters:

(i)a change in the matters set forth in Article 10, paragraph (1), items (i) through (iii) of the Act; and

(ii)beyond what is set forth in the preceding item, changes that the Secretary General of the Consumer Affairs Agency deems not harmful to the proper implementation of solicitations.

(2)A depository service provider that seeks to give a notification of a minor change pursuant to the provisions of Article 12, paragraph (5) of the Act must submit a written notice containing the following matters to the Secretary General of the Consumer Affairs Agency.

(i)the trade name and name, and, if the depository service provider is a corporation, the name of the representative;

(ii)the matters that have changed (indicating comparison between the old and the new);

(iii)the date of the change; and

(iv)the reason for the change.

(Matters to Be Included in the Written Application)

Article 22The matters specified by a Cabinet Office Order, referred to in Article 15, paragraph (1) of the Act, are the following matters:

(i)the customer's name, address, telephone number, and other contact information; and

(ii)the date on which a depository service provider seeks to conclude a sales contract (if a sales contract is already concluded, the date on which said sales contract was concluded), and the date on which the depository service provider seeks to conclude or renew a deposit transaction agreement.

(Documents to Be Attached to Written Applications)

Article 23The documents specified by a Cabinet Office Order, referred to in Article 10, paragraph (2), item (iv) of the Act as applied mutatis mutandis to Article 15, paragraph (1) of the Act, are the following documents:

(i)documents proving that solicitation of a customer was done appropriately within the period of validity of the confirmation specified in Article 9, paragraph (1) of the Act;

(ii)documents proving that the details of a sales contract or deposit transaction agreement for each customer conform with Article 14, paragraph (2), item (i) of the Act;

(iii)documents stating the knowledge, experience, and financial status of each customer and the purpose of concluding a sales contract or concluding or renewing a deposit transaction agreement; and

(iv)beyond the documents set forth in the preceding three items, any documents deemed necessary to determine whether or not to grant confirmation as specified in Article 14, paragraph (2) of the Act by the Secretary General of the Consumer Affairs Agency.

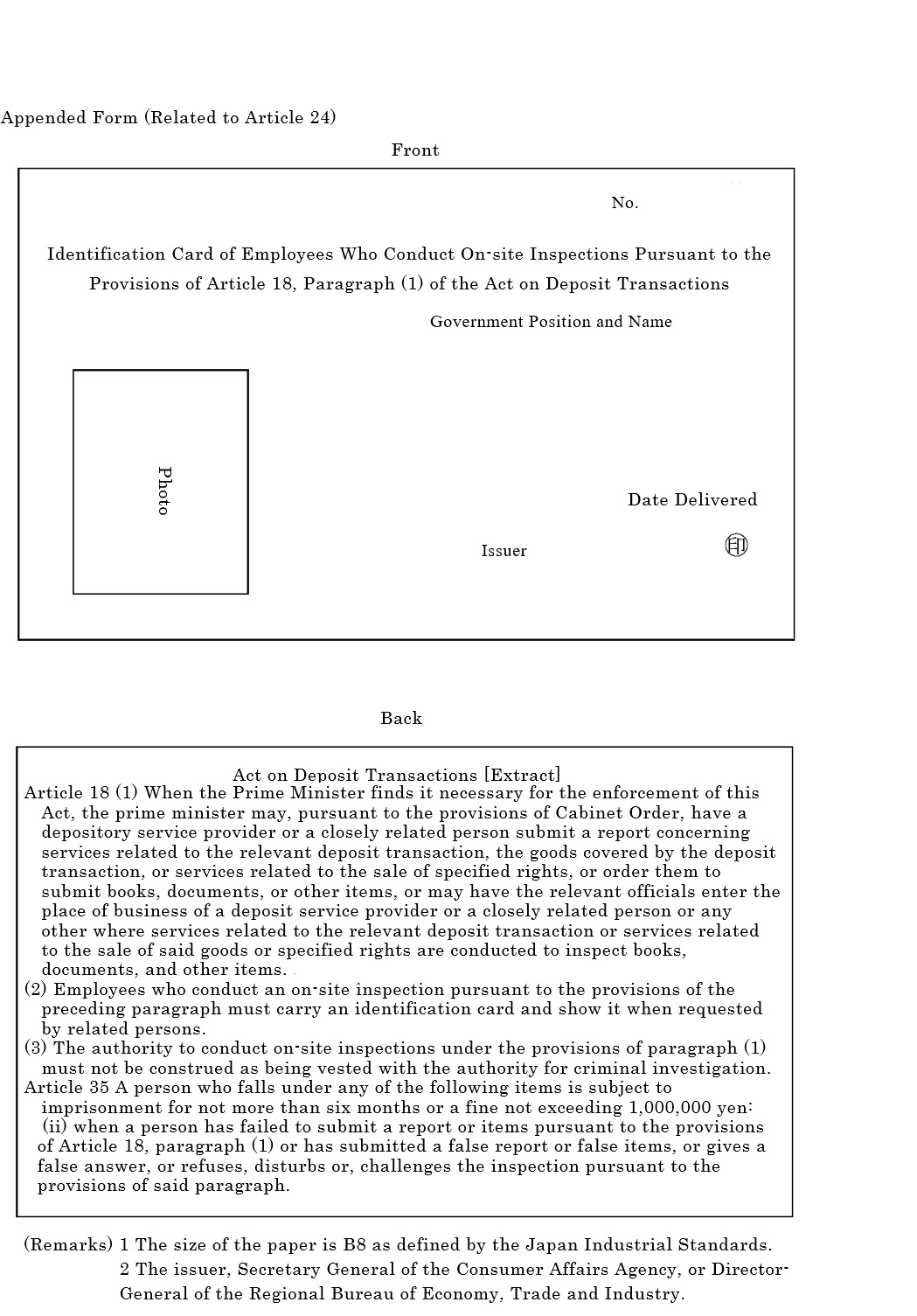

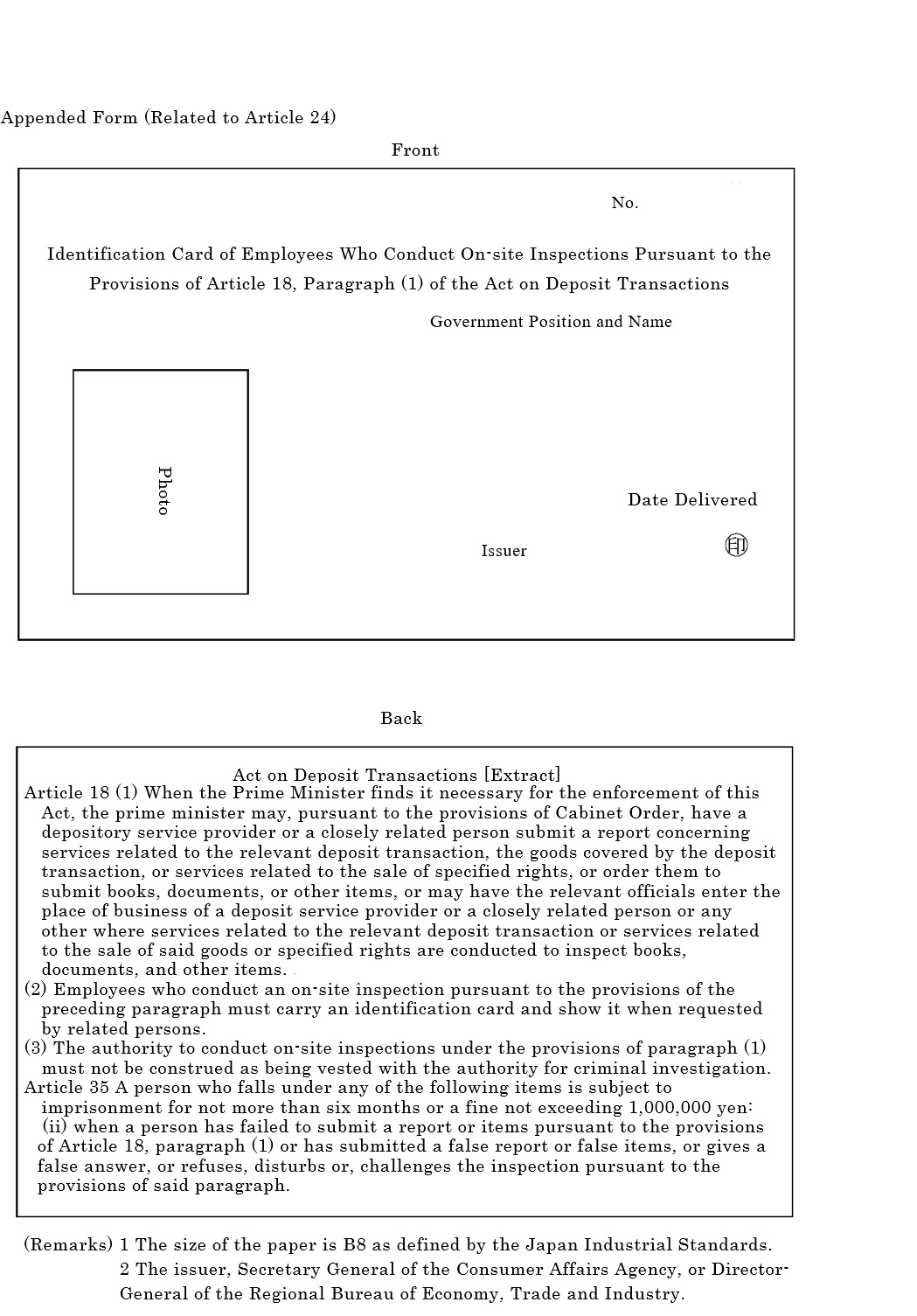

(Identification Cards for On-Site Inspections)

Article 24The certificate of identification for officials conducting on-site inspections under Article 18, paragraph (2) of the Act is to be based on the appended form.

(Persons Specified by Cabinet Office Order and Referred to in Article 20, Paragraph (2) of the Act)

Article 25A person specified by a Cabinet Office Order as prescribed in Article 20, Paragraph (2) of the Act is one who plays the leading role in performing business pertaining to deposit transactions within the scope of suspension pursuant to the provisions of Article 19, paragraph (1) of the Act.

(Persons Equivalent to Those Managing Operations)

Article 26A person specified by a Cabinet Office Order as prescribed in Article 5, item (i) or (ii) of the Order is one who is in a position to regularly take on duties of a person who manages the operations prescribed in these items or any other person who takes on those duties to a substantial extent, irrespective of being a department manager, assistant manager, section chief or having any other title.

(Persons Specified by Cabinet Office Order Under Article 6 of the Act)

Article 27(1)A corporation as specified by Cabinet Office Order under Article 6 of the Order is a person that fulfills the following:

(i)if the depository service provider is an individual, the following corporations:

(a)a corporation in which the depository service provider or an employee thereof is an officer with representative authority;

(b)a company or other corporation (including equivalents to these in foreign countries; hereinafter referred to as "companies, etc." in this Article) in which the depository service provider or an employee thereof holds voting rights constituting not less than 20 percent but not more than 50 percent of the voting rights held by all shareholders (excluding shareholders who are not allowed to exercise their voting rights with respect to all matters that can be resolved at a shareholders meeting; the same applies hereinafter in this paragraph) and members; and

(c)a company, etc. in which the depository service provider or an employee thereof holds voting rights constituting more than 50 percent of the voting rights held by all shareholders and members (including subsidiary companies, etc. and affiliated companies, etc. of the company, etc.).

(ii)if the depository service provider is a corporation, the following corporations:

(a)a subsidiary company, etc. of the depository service provider, a parent company, etc. that has the depository service provider as a subsidiary company, etc., a subsidiary company, etc. of a parent company, etc. that has the depository service provider as its subsidiary company, etc. (excluding the depository service provider, subsidiaries, etc. of the depository service provider, and parent companies, etc. that have the depository service provider as its subsidiary company, etc.), or an affiliated company, etc. of the depository service provider;

(b)a corporation in which an officer or employee of the depository service provider is an officer with representative authority;

(c)a company, etc. in which an officer or employee of the depository service provider holds voting rights constituting not less than 20 percent but not more than 50 percent of the voting rights held by all shareholders and members; and

(d)a company, etc. in which an officer or employee of the depository service provider holds voting rights constituting more than 50 percent of the voting rights held by all shareholders and members (including subsidiary companies, etc. and affiliated companies, etc. of the depository service provider).

(iii)beyond what is set forth in the preceding two items, a corporation that performs part of the business of a depository service provider or business related to said activities and controls policy decisions on the finances and operations or commercial pursuits of said corporation or can have a material influence on the decision of said policies through relationships in terms of contribution, personnel affairs, funds, technology, transactions or other matters.

(2)A "parent company, etc." as specified in item (ii), sub-item (a) of the preceding paragraph means the following companies, etc. that has control over the body that makes decisions on the financial and operational or business policies of another company, etc. (meaning the ensemble of shareholders at a shareholders' meeting or any other bodies equivalent thereto; hereinafter referred to as a "decision-making body" in this paragraph) (excluding those that obviously have no control over the decision-making body of another company, etc. in terms of the financial, operational or business relationships), and a "subsidiary company, etc." as specified in the preceding paragraph and following paragraph means the other company, etc. of which the decision-making body is controlled by the parent company, etc. In this case, when the decision-making body of any other company, etc. is either controlled by the parent company, etc. and a subsidiary company, etc. or by a subsidiary company, etc., that other company, etc. is deemed to be a subsidiary company, etc. of the parent company, etc.:

(i)a company, etc. which, on its own account, holds the majority of voting rights in another company, etc. (excluding another company, etc. which has been subject to an order for the commencement of bankruptcy proceedings, an order for the commencement of rehabilitation proceedings or an order for the commencement of reorganization proceedings or any other company, etc. equivalent thereto, regarding which it is found that no effective controlling interest exists; hereinafter the same applies in this paragraph);

(ii)a company, etc. which holds, on its own account, between forty and fifty percent of the voting rights of another company, etc. and which satisfies any of the following requirements:

(a)the total number of voting rights held by the company, etc. on its own account and the voting rights held by persons who are found to exercise their voting rights in the same manner as the intent of the company, etc. due to a close relationship therewith in terms of contribution, personnel affairs, funds, technology, transactions or other matters, or by persons who agree to exercise their voting rights in the same manner as the intent of the company, etc. constitutes a majority of the voting rights of the other company, etc.;

(b)the majority of the members of the board of directors or any other organ equivalent thereto of such other Corporation, etc. is constituted by the officers (meaning a director, executive officer accounting advisor (if the accounting advisor is a corporation, including a member who is to perform its duties), company auditor, or any other person holding a position similar thereto; the same applies in item (ii), sub-item (a) of the following paragraph), employees or executive members of the Corporation, etc. or persons formerly in such positions, who may exert the influence on such other Corporation, etc. in making decision on its financial policies and operational or business policies;

(c)there exists a contract, etc. concluded between the company, etc. and the other company, etc. that provides for control over decisions of the other company, etc. with regard to any important financial, operational or business policies;

(d)the company, etc. has financed (including the provision of a guarantee of obligation and the provision of securities; the same applies in this item and item (ii), sub-item (b) of the following paragraph) more than half of the total amount of funds procured by such other company, etc. (limited to the amount inserted into the liability section of the balance sheet; the same applies in this item) (including if the amount financed by the company, etc., and the amount financed by a person with a close relationship with the company, etc. in terms of equity, personnel affairs, funding, technology, business transactions, etc. constitutes more than half of the total amount of the funds procured); or

(e)there exists any other fact implying that the company, etc. controls the decision-making body of that other company, etc.

(iii)the company, etc. which falls under any of the requirements specified in (b) through (e) of the preceding item, if the voting rights held by the company, etc. on its own account, and by the voting rights held by any person having a close relationship with the company, etc. in terms of equity, personnel affairs, funding, technology, business transactions, etc. and therefore being likely to exercise its voting rights in concert with the intention of the company, etc. and by any person having consented to exercise the voting rights in concert with the intention of the company, etc. constitute a majority of the voting rights in another company, etc. (including if the company, etc. does not hold voting rights on its own account).

(3)The term "affiliated company, etc." referred to in paragraph (1) means the following companies, etc. (including its subsidiary companies, etc.) specified as other companies, etc. (excluding subsidiary companies, etc.) that are capable of exerting a material influence through investment, assumption of office as a director or other equivalent position by a person that is or has been an officer or an employee of that company, etc., financing, guarantee of obligations, provision of collateral, provision of technology, or transactions, etc. in operations and business; provided, however, that this does not apply if it is clearly found that the company, etc. (including a subsidiary company, etc. of such company, etc.) is unable to have any material impact on the decision on the financial policies and operational or business policies of another company etc. other than a subsidiary company, etc., in light of its financial, operational or business relationship therewith:

(i)the other company, etc. excluding subsidiary companies, etc., if a company, etc. (including a subsidiary company, etc. of such company, etc.) holds on its own account 20 percent or more of the voting rights in the other company, etc. excluding subsidiary companies, etc. (excluding another company, etc. that is not a subsidiary company, etc. and has been subject to an order for the commencement of bankruptcy proceedings, order for the commencement of rehabilitation proceedings or order for the commencement of reorganization proceedings, or another company, etc. excluding subsidiary companies, etc. and is equivalent thereto, in which case it is found that the company, etc. would not be able to give any material impact on the decision on its financial policies and operational or business policies; the same applies hereinafter in this paragraph);

(ii)the other company, etc. excluding subsidiary companies, etc. that falls under any of the following requirements, if the company, etc. (including a subsidiary company, etc. of such company, etc.) holds on its own account 15 percent or more but less than 20 percent of the voting rights in another company, etc. excluding subsidiary companies, etc.:

(a)an officer, employee, or executive member of the company, etc. or any person that has formerly been in such a position and is able to give an impact on decision of its financial policies and operational or business policies, holds the office of its representative director, director, or a position equivalent thereto;

(b)any important loan has been granted by the company, etc.

(c)any important technology is furnished by the company, etc.;

(d)there are any operational or business transactions with the company, etc.; or

(e)there exists any other fact implying that the company, etc. is able to have a material impact on the decision on its financial, operational or business policies;

(iii)the other company, etc. excluding subsidiary companies, etc. that falls under any of the requirements listed in (a) through (e) of the preceding item, if 20 percent or more of the voting rights in the other company excluding subsidiary companies is constituted by the voting rights held by the company, etc. (including subsidiary companies, etc. of the company, etc.) on its own account, and by the voting rights held by any person having a close relationship with the company, etc. in terms of equity, personnel affairs, funding, technology, business transactions, etc. and therefore is likely to exercise the voting rights in concert with the intention of the company, etc. and by any person having consented to exercise the voting rights in concert with the intention of the company, etc. (including if the company, etc. does not hold voting rights on its own account).

(Documents Specified by Cabinet Office Order Under Article 22 of the Act)

Article 28The documents specified by a Cabinet Office Order, referred to in Article 22 of the Act, are the documents specified in each of the following items, in accordance with the categories of exercise of authority specified in each of the following items:

(i)the confirmation specified in Article 9, paragraph (1) of the Act, the confirmation of change specified in Article 12, paragraph (1) of the Act, and the confirmation specified in Article 14, paragraph (2) of the Act: documents stating the details of the relevant confirmation;

(ii)the rescission pursuant to the provisions of Article 13 or Article 16, paragraph (1) of the Act, or the order pursuant to the provisions of Article 19, paragraph (1), Article 20, paragraph (1) or (2), or Article 21, paragraphs (1) through (3): documents stating the details of the relevant adverse disposition, the provisions of laws and regulations which serve as its grounds, and the fact causing it; and

(iii)an order for the collection of reports of submission of documents pursuant to the provisions of Article 18, paragraph (1) of the Act.

Supplementary Provisions [Extract]

(Effective Date)

Article 1This Order comes into effect as of the date of enforcement (June 1, 2022) of the Act on Partial Revision of the Act on Specified Commercial Transactions for Facilitating the Prevention of Harm to Consumers and Promotion of their Recovery (Act No. 72 of 2021).

(Abolishment of the Cabinet Office Order Specifying the Form of Identification Card by Employees Who Conduct On-site Inspections Based on the Provisions of the Act on Deposit Transaction Agreements for Specified Commodities)

Article 2The Cabinet Office Order Specifying the Form of Identification Card by Employees Who Conduct On-site Inspections Based on the Provisions of the Act on Deposit Transaction Agreements for Specified Commodities (Order of the Ministry of Agriculture, Forestry and Fisheries, Ministry of International Trade and Industry, and Ministry of Transport No. 1 of 1986) shall be abolished.

(Transitional Measures)

Article 3The provisions of Article 3 apply to deposit transaction agreements concluded or renewed on or after the Enforcement Date of this Order, and the prior laws continue to govern deposit transaction agreements concluded or renewed prior to the Enforcement Date.

Supplementary Provisions [Cabinet Office Order No. 13 of February 1, 2023]

(Effective Date)

Article 1This Order comes into effect as of the date of enforcement set forth in Article 1, item (iii) of the Supplementary Provisions of the Act on Partial Revision of the Act on Specified Commercial Transactions for Facilitating the Prevention of Harm to Consumers and Promotion of their Recovery (referred to as "Act for Revision" in Article 3) (June 1, 2023; hereinafter referred to as "Enforcement Date").

(Transitional Measures)

Article 2The provisions of Articles 4 through 9 of the Regulation for Enforcement of the Act on Deposit Transactions amended by this Order (referred to as the "New Order" in the following Article and Article 4) apply to deposit transaction agreements concluded or renewed on or after the Enforcement Date.

Article 3The provisions of Article 10, paragraph (7) of the New Order apply to acts of obtaining consent pursuant to the provisions of Article 3, paragraph (3) of the Act on Deposit Transactions amended by the Act for Revision (referred to as the "New Act" in the following Article) and acts of provision through electronic or magnetic means pursuant to the provisions of the same paragraph.

Article 4The provisions of Article 17, item (viii) and Article 20, item (iv) of the New Act apply to applications and inspections for confirmation for solicitations prior to the Enforcement Date and those that seek to obtain consent pursuant to the provisions of Article 3, paragraph (3) of the New Act on or after the Enforcement Date.

Appended Form